Dollar-Cost Averaging: A Sensible Approach to Investing

Investing in the financial markets can be an intimidating prospect, especially for those new to the world of investments. However, there are strategies that can help mitigate risk and make investing more accessible and less daunting. One such strategy is dollar-cost averaging (DCA), a method that allows investors to build a portfolio over time by regularly investing a fixed amount of money. Let’s explore the concept of dollar-cost averaging, its benefits, and how it can contribute to long-term financial success.

Understanding Dollar-Cost Averaging

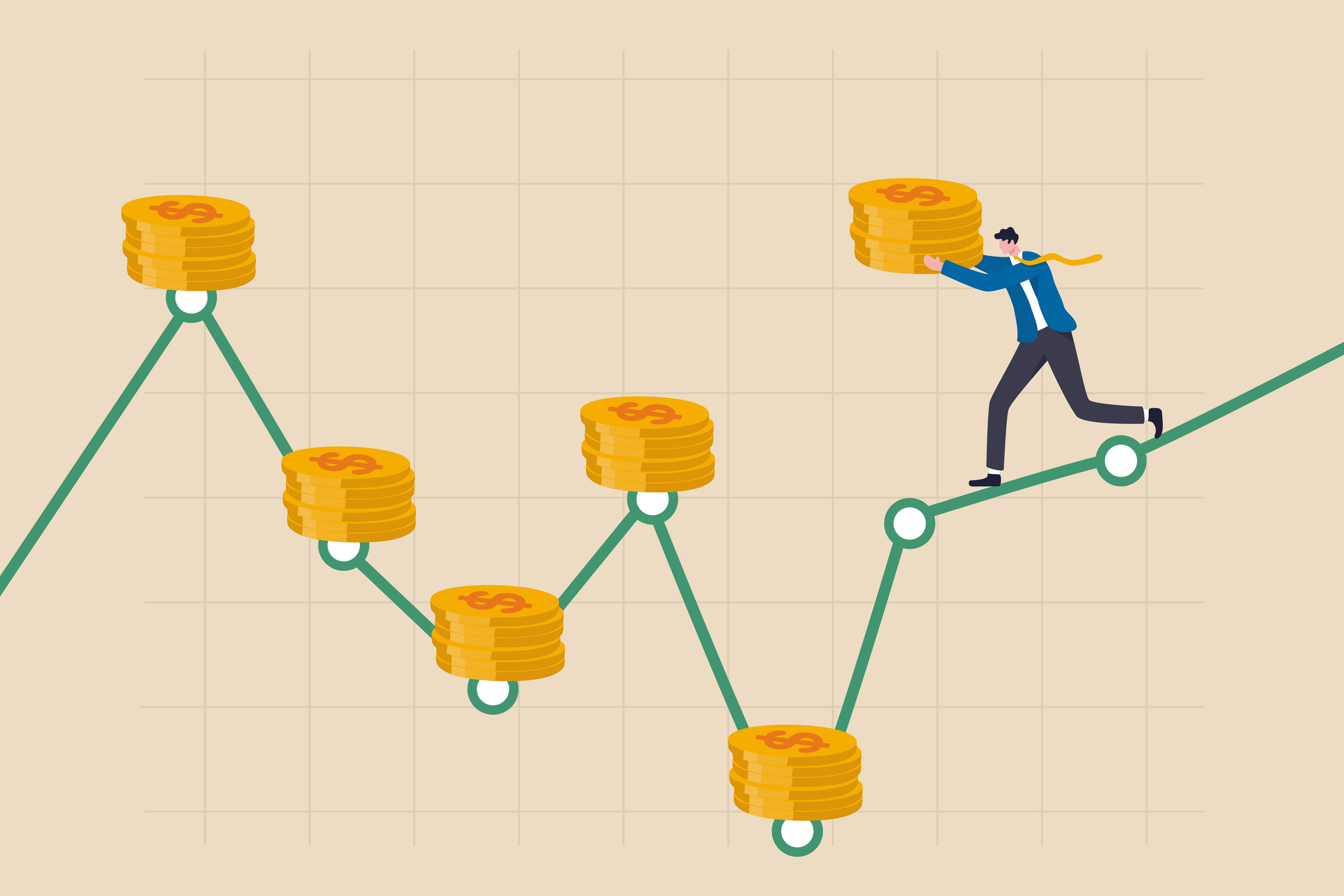

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This means investing the same amount consistently, whether prices are high or low. The strategy works by buying more shares or units of an investment when prices are low and fewer shares when prices are high. Over time, this approach helps smooth out the impact of short-term market volatility and reduce the risk associated with trying to time the market.

Benefits of Dollar-Cost Averaging

- Risk Mitigation: One of the key advantages of dollar-cost averaging is that it reduces the risk of making poor investment decisions based on short-term market fluctuations. By consistently investing a fixed amount at regular intervals, investors avoid the temptation to time the market and make emotionally driven investment choices. This approach helps smooth out the impact of market highs and lows, minimizing the risk of making significant losses.

- Disciplined Investing: Dollar-cost averaging promotes disciplined investing by establishing a routine of regular investments. Instead of making sporadic investment decisions based on market conditions, investors commit to a set schedule, ensuring consistent contributions to their investment portfolio. This disciplined approach can help individuals develop healthy investing habits and stick to their long-term financial goals.

- Potential for Lower Average Purchase Price: Since dollar-cost averaging involves buying more shares or units when prices are low, investors have the potential to accumulate assets at a lower average purchase price over time. This can enhance long-term investment returns when prices rise, as investors benefit from the appreciation of the investments accumulated during periods of lower prices.

- Reduced Emotional Bias: Emotional bias can cloud judgment and lead to irrational investment decisions. Dollar-cost averaging helps mitigate emotional bias by automating investment contributions at regular intervals. By following a systematic approach, investors are less likely to make impulsive decisions based on short-term market volatility or external factors, such as news headlines or market sentiment.

Implementing Dollar-Cost Averaging

Implementing dollar-cost averaging is relatively straightforward. Here are the steps to get started:

- Set Investment Goals: Determine your investment goals and time horizon. Consider factors such as your risk tolerance, financial objectives, and investment timeframe.

- Choose Investments: Select a diversified portfolio of investments that align with your goals and risk tolerance. This could include mutual funds, exchange-traded funds (ETFs), or individual stocks and bonds.

- Determine Investment Amount: Determine the amount of money you can comfortably invest on a regular basis. This could be a fixed amount per month or per quarter.

- Set a Regular Investment Schedule: Establish a regular schedule for your investments, such as monthly or quarterly contributions. Consistency is key in dollar-cost averaging.

- Automate Contributions: Automate your investment contributions through automatic bank transfers or setting up a systematic investment plan (SIP) with your brokerage account or fund provider. This ensures that investments are made consistently without requiring manual intervention.

- Stay Committed: Stick to your investment plan and remain committed to your regular investment schedule, regardless of market conditions. Avoid the temptation to deviate from the strategy based on short-term market fluctuations or emotional reactions.

Conclusion

Dollar-cost averaging is a simple yet powerful investment strategy that can help individuals build wealth and achieve their long-term financial goals. By investing a fixed amount at regular intervals, investors can navigate market volatility, mitigate risk, and reduce the emotional bias that often plagues investment decisions. While dollar-cost averaging does not guarantee profits or protect against losses, it provides a disciplined approach to investing and can contribute to long-term financial success. So, whether you are a seasoned investor or just starting your investment journey, consider incorporating dollar-cost averaging into your investment strategy and embrace the benefits of consistent and systematic investing.

Share this content: